Illinois Business Insurance

Get the Coverage You Need

Simply Business is pleased to provide tailored insurance options from:

The “Land of Lincoln” is ripe with business opportunities. Small businesses make up 99.6% of all companies in the state, and there are state-funded programs dedicated to supporting entrepreneurs. If you want to get in on the action, there are a few steps you can take.

The Starting Your Business in Illinois Handbook covers topics ranging from choosing a business structure to getting permits and beyond. Today, we’re homing in on business insurance. Finding which Illinois business insurance requirements apply to you is a critical step in starting a business. There also are some policies that you need to consider as your business grows.

We know you probably didn’t leap out of bed this morning because you couldn’t wait to learn about insurance. It doesn’t have to be complicated, though, and we’re here to prove that with this simple guide.

Illinois Business Insurance: The Basics

Let’s get the big question out of the way — what is business insurance? Most of us are familiar with health insurance coverage or auto insurance, but business insurance policies are uncharted territory.

No, your business can’t get into a fender bender and doesn’t need help paying for prescriptions, but It can, however, wind up in the middle of a lawsuit. We’ll review the different scenarios that business insurance policies typically cover later on in this article.

For now, all you need to know is that Illinois business insurance could take some weight off your bank account (and sanity) if your business activities were to cause an accident.

Everyone makes mistakes, but you shouldn’t have to risk potentially losing your business because of one. That’s why getting business insurance is a small step that could make a big impact on your company’s security.

Illinois general liability insurance

If you want a policy that typically covers a wide range of scenarios and is useful for many businesses, look no further than Illinois general liability insurance. It’s so valuable that the state won’t let some companies operate without it (more on that in a minute, though).

General liability insurance typically covers:

- Third-party damage, such as to a client or vendor

- Bodily injury

- Medical expenses

- Defective product claims

- Personal and advertising injury

- And more

Now let’s talk about who needs Illinois general liability insurance. There’s no one-size-fits-all requirement, but some occupations are required to carry business insurance. Even without legal requirements, many types of businesses could benefit from insurance coverage.

Your insurance requirements usually depend on the type of work you do and where your business operates. That means you should check for both state-level insurance rules as well as your county and city levels.

Let’s explore a few occupations with legal requirements for Illinois general liability insurance and what scenarios it could help.

-

Roofers need at least $500,000 in general liability insurance coverage. Here’s a scenario where having roofing business insurance could pay off. Imagine a roofer is working on a multi-day project, and they cover the roof with a tarp at the end of the workday.

Overnight, a big storm rolls in, and the homeowners sustain thousands of dollars of water damage in their bedroom. The contractor can’t control the weather, but their business insurance coverage could help pay for the damages the homeowners demand, up to the policy limit.

-

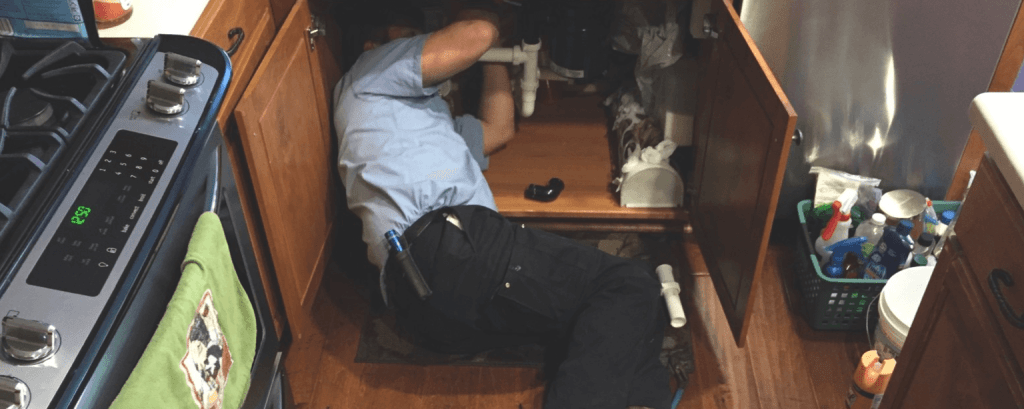

An asbestos abatement contractor also needs Illinois general liability insurance — to the tune of at least $1,000,000. If a handyman offers this as one of their services, business insurance could help them out in case of an accident. What could that look like? Let’s say the handyman set up a ladder and then walked away to get another tool.

In the meantime, the homeowner’s child knocks over the ladder and brings it crashing down onto their head. The homeowners are furious and sue the handyman for the cost of the medical bills. Considering the average customer injury claim is $30,000, the handyman would be grateful to any financial assistance that insurance could offer.

-

Another occupation with an Illinois general liability insurance requirement is a locksmith. Imagine a locksmith is on the job when their mind wanders. As they’re lost in thought, the locksmith inadvertently cuts a hole that’s too large and ruins the door.

If the homeowner wants the locksmith to pay to replace the door, locksmith business insurance could help with the costs.

If you’re a contractor in Illinois, you’ll need to have insurance before you can get your license. We have a guide to getting your contractor license in Illinois here. Business owners who have state insurance requirements need to maintain coverage, since the state may revoke their license if coverage lapses.

As we mentioned, Illinois general liability insurance is sometimes recommended for businesses without state requirements. In addition to potentially helping business owners cover the costs of damages and lawsuits, this type of business insurance also can help you:

-

Build trust with potential customers. Customers consider a lot of things when choosing a company to work with, and a Certificate of Insurance (COI) could grant a point in your favor.

Along with positive customer reviews, proof of insurance can build trust before the project starts.

-

Attract employees. People want to work for stable, reliable companies that care about their employees. Since Illinois general liability insurance could help your company weather the storm of a lawsuit, having coverage might help more potential employees to consider working for you.

-

Set yourself apart from the competition (or scammers). Unfortunately, many industries have untrustworthy players ready to scam customers. Having business insurance could be one way to send a clear signal that you aren’t one to mess with shady business tactics.

-

Rent retail space or storage. If retail space or storage is in high demand in your area, having business insurance could help you win a bid. Showing landlords your proof of coverage might help them feel better about choosing you as a tenant.

Professional liability insurance in Illinois

The next type of policy to consider is professional liability insurance. This type of policy typically covers negligence claims, legal defense costs, libel or slander claims, copyright infringement, and more.

We recommend professional liability insurance in Illinois for many occupations, including:

- Project managers

- Event planners

- Management consultants

- Accountants

- Bookkeepers

- Photographers

- Real estate agents

- Graphic designers

- Life coaches

- And more

There are no standard requirements for professional liability insurance in Illinois. Typically, the state creates insurance laws for specific occupations.

Similar to general liability insurance, though, professional liability insurance is helpful to many business owners.

Take a real estate agent as an example. If they fail to submit an offer on the agreed-upon timeline, the home buyers might blame the agent for losing out on their dream home.

In that case, the home buyers could sue the real estate agent for negligence, even though it was an honest mistake.

Unfortunately, you don’t have to do anything wrong to end up in the middle of a negligence claim. Even if you avoid paying damages, you could still have legal costs that racked up while trying to prove your innocence.

Having professional liability coverage could help cover legal costs from the lawsuit.

Illinois workers compensation insurance

Until now, we’ve talked about insurance plans that have grey areas around legal requirements.

That changes with Illinois workers compensation insurance. The simple fact is that you likely need workers comp coverage if you have part-time or full-time employees.

If your employee gets injured or sick on the job, Illinois workers compensation insurance generally helps cover medical bills and lost wages. In Illinois, benefits are paid regardless of fault and whether or not the injury was in whole or in part a result of the employee’s work.

Other types of Illinois business insurance

In addition to the three main types of Illinois business insurance policies, you also may consider:

-

Home-based business insurance. Are you starting your business from a home office? You may want a home-based business insurance policy. Home insurance policies don’t typically protect home-based businesses, and general liability may not cover that space, either.

-

Commercial auto insurance. Illinois drivers have minimum insurance requirements, but these usually focus on personal vehicles. If you use a work vehicle, such as a catering van or car to get to business meetings, you may want additional coverage.

-

Surety bonds. While surety bonds aren’t insurance, they are a requirement for some occupations such as roofing contractors. A construction bond is an agreement between you, your customers, and a bond issuer that incomplete work or damages will be paid for.

-

Flood insurance. In Illinois, 15% of the state’s land area is subject to flooding, so you may want to consider extra insurance for your office space.

Illinois Workers Compensation: What You Need to Know

Workers compensation insurance helps ensure that employees are reimbursed for workplace injuries and that employers can pay. If you have even one part-time employee, you need coverage under Illinois law.

The few exceptions to this rule include:

- Family members who are corporate officers

- Companies that employed less than 400 days of agriculture work per quarter in the previous year

When it comes time for you to get Illinois workers compensation insurance, be sure to shop around. Illinois has more companies offering workers compensation insurance than any other state.

How Much Does Illinois Business Insurance Cost?

Trying to answer the question “how much does Illinois business insurance cost?” is about as straightforward as telling you how much a house costs. Both come with many varying factors to consider and will be individually specific.

In general, Illinois business insurance prices could depend on:

- The type of work you do

- Which policies you choose

- The size of your business

While this variability makes it hard to nail down a single price estimate, it also means you don’t have to worry about buying a policy that’s beyond your needs. Since each quote is customized based on your business, you get to choose the one that works for you.

Since getting an Illinois business insurance quote is fast and free, there’s no downside to shopping around. You can get custom quotes in minutes by answering a few questions online or talking one-on-one with a Simply Business agent at 855-541-0919.

If budget is a concern of yours, you might be happy to know that you can generally deduct the cost of insurance premiums from your business tax filings.

How Do I Get Illinois Business Insurance?

Phew! That was a lot of business insurance info in a short amount of time. Let’s recap what we’ve covered:

-

Illinois general liability insurance usually covers situations such as damaged client property, injuries, and more. Some occupations have legal requirements in the state, like contractors, while coverage is recommended for other business types, as well.

-

People who provide advice or offer professional services, from coaching to photography to real estate brokerage and beyond, should consider professional liability insurance in Illinois.

It’s typically not required, but it could help you if a disgruntled client claims you were negligent.

-

Illinois workers compensation insurance is required for businesses with employees, even if it’s only one. Part-time and full-time workers count toward your roster.

-

Generally, Illinois business insurance could help cover lawsuits or damages that result from business activities. This means a small monthly investment might help you avoid a bill so large it sends your company into bankruptcy. Having proof of coverage is also great to show potential customers, lenders, and landlords.

Our goal with this guide is to give you an overview of Illinois business insurance so that you can cut through the confusion and get started. As we mentioned, though, there can be a nuance in insurance requirements. Here are our best tips for finding the coverage that’s right for your business right now:

-

Talk to business owners in your area about what policies they have. It’s even better if you find people in your industry.

-

Search the Directory of Associations to find groups dedicated to your line of work. Connecting with associations can help you find requirements, resources, and advice.

-

Compare insurance quotes across providers to find the coverage and cost that you’re comfortable with.

-

Find registration and licensing rules for your business. Applications and rules for business licensing in Illinois tend to list insurance requirements.

-

Think about how your business will grow in the next year and whether that could impact insurance requirements.

-

Visit the Illinois Department of Public Health for license and insurance requirements in industries like asbestos abatement, healthcare, plumbing, and more.

-

If you’re shopping for insurance on the Simply Business platform, feel free to reach out to our insurance agents to answer any questions you may have.

-

Read through the Illinois Department of Commerce’s “Starting Your Business in Illinois Handbook” for info about every step of starting a business.

-

Talk to local lawyers and accountants for Illinois-specific questions you can’t find the answer to.

-

If your business offers more than one service, be sure to check insurance requirements and recommendations for each project type.

-

Review licensing requirements for occupations like cosmetology, roofing, and home inspections through the Illinois Department of Financial and Professional Regulation. Each occupation’s page has a “Laws and Rules” section, and it’s helpful to search for the word “insurance” in the linked documents.

-

Search for the Illinois Small Business Development Center nearest you to get business coaching and assistance.

-

Download your Certificate of Insurance (COI) once you have a policy. This proves that you’re covered, and the COI may be needed to get your license, rent office space, and more.

Celebrate this Next Phase of Your Business Journey

There are milestones in your business that mark a turning point. These include the decision to finally give entrepreneurship a shot, naming your business, and hiring your first employee. While getting Illinois business insurance might not feel as exciting as those moments, it’s just as important.

If you’re required to get coverage, having an insurance policy marks the start of your business. If you’re being proactive and getting insured without a requirement, this moment represents a new level of commitment.

We’re here to help at every step of your business journey. Check out our blog to learn about growing a business, talk to one of our licensed insurance agents at 855-541-0919, or get a free custom quote with our online tool.

Businesses We Insure

- Architect Insurance

- Attorney Insurance

- Digital Marketing Insurance

- Dj Insurance

- Draftsman Insurance

- E-commerce Insurance

- Education Consultant Insurance

- Engineering Insurance

- Financial Planner Insurance

- Home Inspector Insurance

- Insurance For Insurance Agents

- Interior Design Insurance

- Insurance It Consulting

Other Businesses We Insure

- Land Surveyor Insurance

- Lawyer Insurance

- Life Coach Insurance

- Management Consultant Insurance

- Mortgage Broker Insurance

- Photographers Insurance

- Insurance For Private Tutors

- Project Manager Insurance

- Real Estate Agent Insurance

- Social Work Insurance

- Tax Preparer Insurance

- Travel Agent Insurance

- Videographer Insurance

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.