Insurance for Career Coaches

Compare Free Quotes and Get an Affordable Policy in Less Than 10 Minutes.

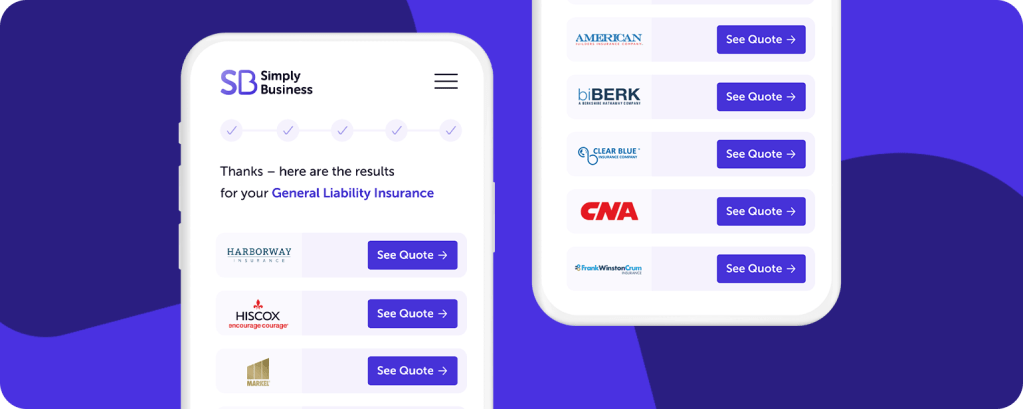

Simply Business is pleased to provide tailored insurance options from:

Need Business Insurance? We’re in Your Corner.

As a career coach, you guide your clients toward a better understanding of themselves and their future career paths. They count on you for advice, honesty, and expertise. With so much at stake, you’ll want to consider purchasing career coaching insurance.

At Simply Business, we help protect professional coaches with affordable insurance that can fit your business’s needs. We work with the nation’s top insurance companies to find policies that cover the risks you could encounter as a career coach.

All it takes is 10 minutes. Get a quote, get insured, and get back to helping your clients.

Business Insurance FAQs:

What is General Liability Insurance?

Insurance policies available for career coaches:

Benefits of career coach insurance:

- It can protect your business from certain claims.

- It can cover damages caused by your negligence.

- Proof of insurance can help clients feel good about using your services.

What Types of Insurance for Career Coaches Should I Consider?

Helping people achieve their career goals is your calling. And it’s your business. As a professional career coach, you never know what may stand in the way of your success. Obtaining insurance will help protect your business from unforeseen circumstances.

Here are three types of policies we typically recommend:

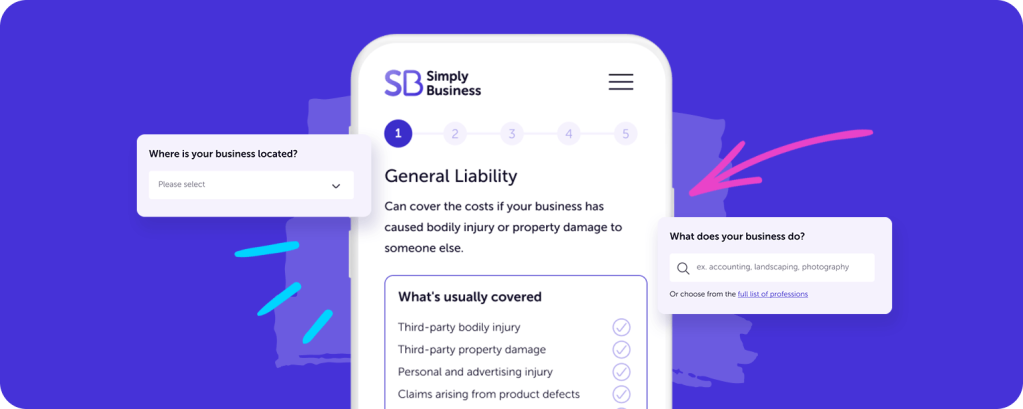

General Liability Insurance

Having general liability insurance can help protect your business if you cause third-party property damage or bodily injury to another person. Many small business owners may experience accidents that damage third-parties which can lead to claims. As a career coach, you may not think these scenarios are something you have to worry about, but they are more common than you might think.

Here’s an example: One of your clients visits your office for a coaching session. On his way out the door, he trips on a loose stone step and falls. He breaks his wrist and winds up suing your business for his medical expenses and emotional distress.

Without business insurance, you could be responsible for the medical expenses and other claims — and that cost would come out of your pocket. But if you have a general liability policy, you may be in luck. In this scenario, general liability insurance would likely help cover your client’s medical expenses and many other costs associated with a lawsuit.

Here’s what you can expect general liability insurance to cover:

- Third-party bodily injury

- Third-party property damage

- Personal and advertising injury

- Medical expenses

However, it usually doesn’t cover the following:

- Property damage to your own business

- Professional services

- Workers’ compensation or an employee’s injury

- Damage to your work

- Vehicles while in business use

- Expected or intentional injury or damage

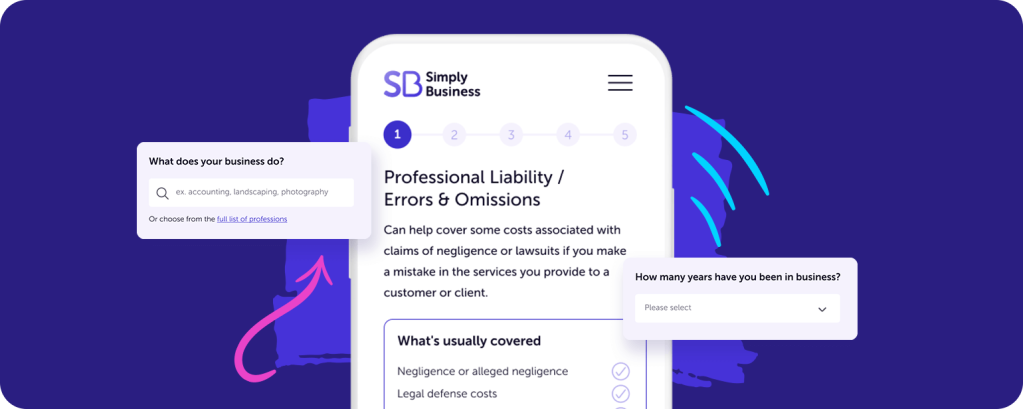

Professional Liability Insurance

Your clients hire you to give them career advice. But what if their plans don’t play out the way they expected? As a professional business coach, your consultations with clients open you up to potential negligence claims. That’s why we recommend professional liability insurance.

Professional liability insurance, also known as professional indemnity insurance, can cover you if a client claims that you or your business were negligent when providing them with services, even if you disagree with the claim.

Let’s say your client is a high-level executive who wants to change her career to have a better work-life balance. You suggest she take the two-week vacation she’s been putting off for years to relax and reflect on her future goals. Instead, she quits her job and relocates to a tropical island where she’s unable to find work. She sues you for giving her bad advice.

Unfortunately, you’re on the hook for those legal fees if you don’t have insurance. And the cost of a lawsuit could be devastating to your business. If you had professional liability insurance, in this situation your policy would likely help cover your legal costs and any potential settlement fees.

Professional liability insurance typically covers:

- Negligence or alleged negligence

- Legal defense costs

- Claims involving libel and/or slander

- Claims and damages

Professional liability insurance does not usually protect you from:

- Property damage or bodily injury

- Intentional acts and omissions

- Medical expenses

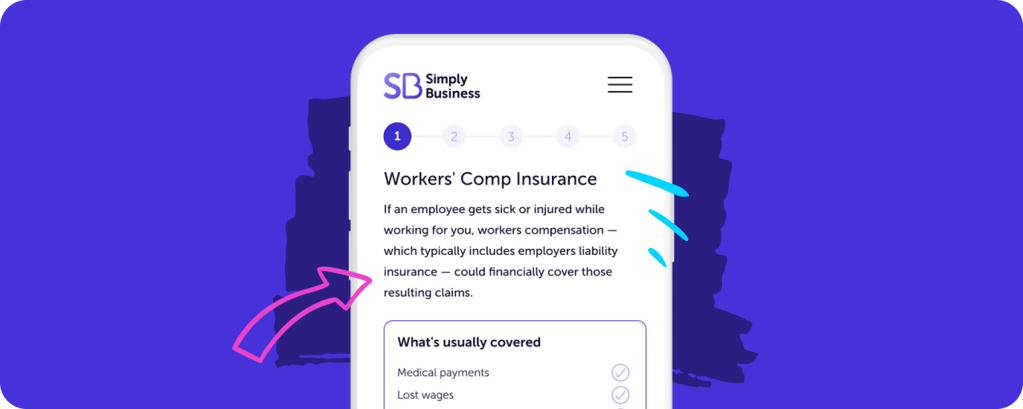

Workers’ Compensation Insurance

Another insurance you should consider as a career coach is workers’ compensation insurance. This insurance protects your business if an employee gets hurt, injured, or sick while on the job. Even with only one temporary or part-time employee, your state may require that you carry workers’ comp.

Work injuries can be expensive. The average cost of a workers’ comp claim was $40,051 from data collected in 2019 and 2020. Using that same data, a slip or fall accident averaged over $46,000. While you may not expect to need this coverage as a career coach, just think about what you may have to pay for your employee’s medical bills, emergency room visit, and more. With workers’ comp, you have financial protection and peace of mind that your employee’s injury won’t put your business at risk.

Workers’ compensation can cover:

- Medical payments

- Lost wages

- Rehabilitation expenses

- Death benefits

When referred to together we’ll call General Liability, Professional Liability, and Workers’ Compensation Insurance as “Career Coach Insurance.”

Why Do I Need Insurance as a Career Coach?

Simply put, anyone can be sued by a client or an employee — even a career coach. Did you know that somewhere between 36% and 53% of small businesses are involved in litigation every year? These lawsuits are usually the result of accidents, injuries, and loss of revenue. As a business owner, you want to ensure that you’re helping to protect your business from risk.

You spend your days providing others with support and direction. We’re here to offer guidance when it comes to keeping your business safe. At Simply Business, we’ll help you stay protected with insurance for career coaches. You’ll rest easy knowing you’re better protected financially if something unexpected occurs.

Our insurance plans are designed to fit your needs, and we make it easy to compare quotes online so that you can find a suitable policy.

Insurance for Career Coaches FAQs

Why Choose Simply Business?

You set people up for success, and we do too! At Simply Business, we offer the coverage small business owners need most. And we can help tailor your policy to your business needs. That’s how we’ve helped insure more than 60,000 businesses across the U.S.

We’ll help you shop, compare, and buy business insurance policies from some of the nation’s most trusted insurers — all in mere minutes. Tell us a little bit about your career coaching business, and we’ll help you choose the policy that’s right for you. Online or on the phone.

What else sets us apart?

- We’re fast and affordable. You have a lot on your plate, and your time matters. Our easy quote process gets you covered in a few minutes so that you can get back to your busy schedule.

- We’re flexible. Choose a policy to get started and increase coverage as your business evolves. We’re here to grow with you.

- We recognize your business is unique. Our quote process helps you find coverage that fits your needs.

You’ve worked hard to build your career coaching business. Now you can choose the coverage to protect it.

Other Businesses We Insure

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.