As anyone who’s ever started a business knows, getting one off the ground is not for the faint of heart. Entrepreneurs face numerous challenges in the early years, from solidifying business plans to navigating the complexities of hiring employees and acquiring licenses and insurance. These hurdles often determine the fate of a startup, making the journey from an idea to a successful enterprise both difficult and uncertain.

Each year, millions of Americans file new business applications, but only a fraction of these ventures transition to hiring employees. Among those that do, surviving the critical first few years can still be an uphill battle. However, business survival rates differ significantly by location, influenced by a variety of factors such as economic conditions, state policies, and industry-specific demand. The good news is that businesses that weather the initial hurdles see a much greater likelihood of long-term success.

This analysis explores the states where new businesses are most likely to survive their earliest years based on the latest data from the U.S. Bureau of Labor Statistics (BLS). The findings reveal important insights into how location and time impact the chances of business success.

FOR BUSINESS OWNERS

There are many business insurance options for small business owners, each tailored to the unique needs of the different types of businesses out there. Before you buy business insurance online, we can help you learn about the various coverage options and whether they’re suited for your business.

How Likely Are New Businesses to Remain Open?

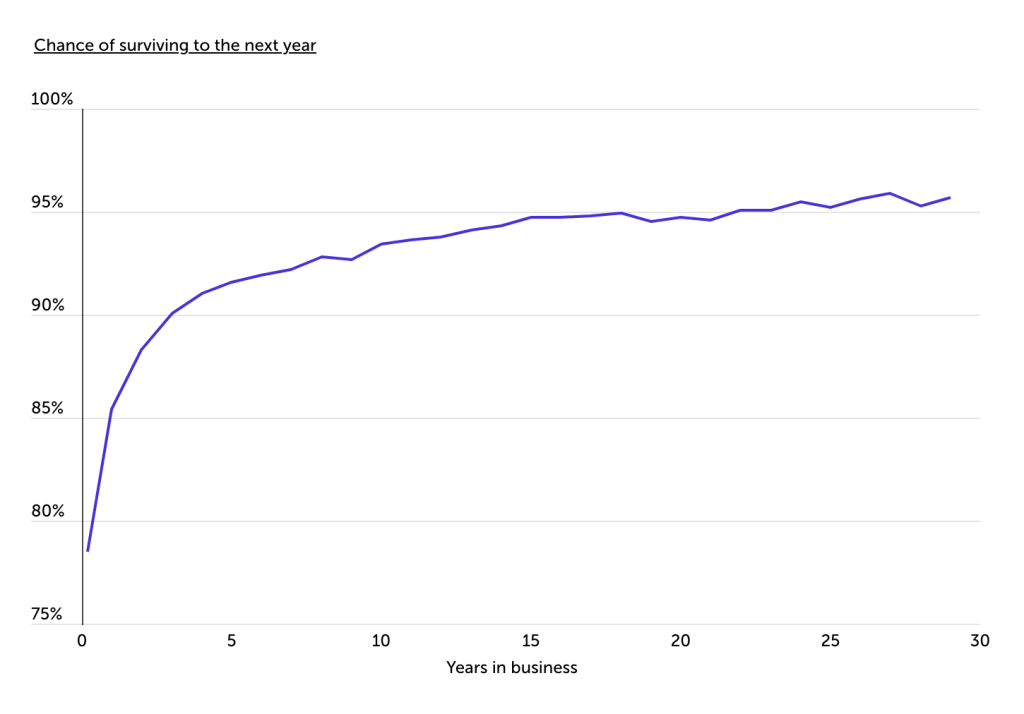

The chances of staying in business increase dramatically after the first few years

Source: Simply Business analysis of U.S. Bureau of Labor Statistics data | Image Credit: Simply Business

One of the most significant challenges for new business owners is simply staying in operation. The risk of failure is highest during the first year, but it diminishes considerably over time. For those businesses that survive the initial hurdles, the likelihood of long-term success grows each year.

According to recent BLS data, only about 79% of businesses survive their first year, making it the most difficult period for startups. However, for businesses that survive their first year, roughly 85% make it to the next. By the fifth year, 91% of businesses manage to continue operations, and for those that reach the 10-year mark, an impressive 93% make it through to another year. These figures underscore the importance of persistence and adaptability, especially during the critical early years when the risk of failure is highest. They also highlight that while starting a business is undeniably challenging, those who endure the startup years enjoy far better odds moving forward.

OPERATE YOUR SMALL BUSINESS WITH CONFIDENCE

One way to make sure your business is protected is with professional liability insurance, which covers a variety of potential claims against your business—typically involving human error. Compare professional liability insurance quotes for your business today.

Where New Businesses Are Most Likely to Succeed

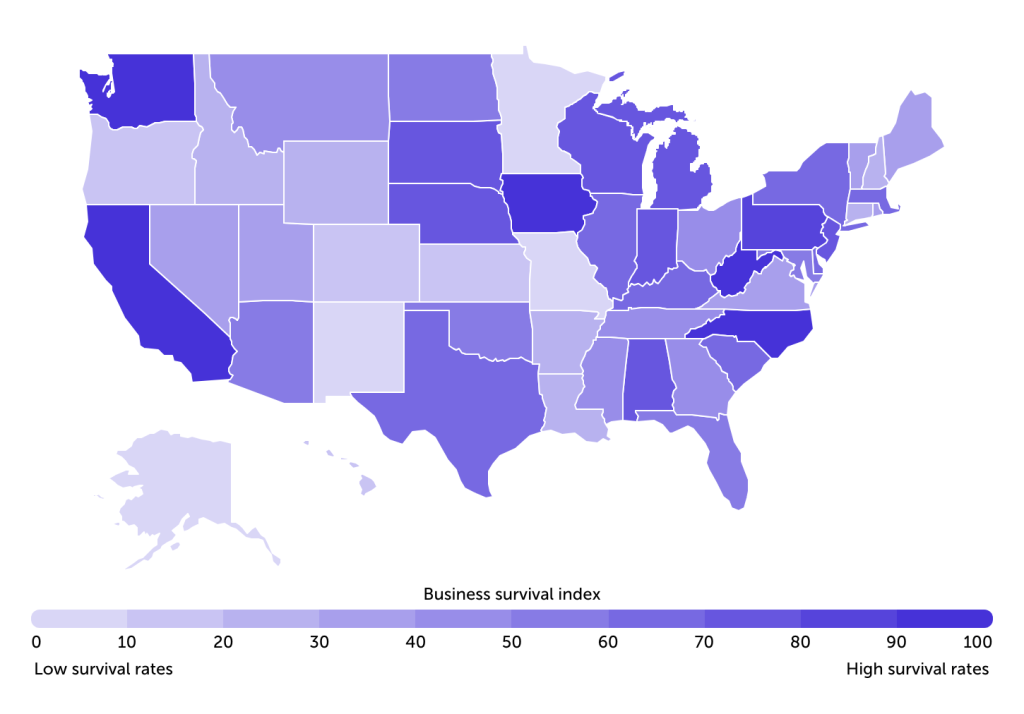

Washington & California lead the country in new business survival rates

Source: Simply Business analysis of U.S. Bureau of Labor Statistics data | Image Credit: Simply Business

New business success varies widely across the United States, with some states providing a more favorable environment for startups to thrive. Based on survival rates for the first three years of operation, Washington and California stand out as the nation’s leading states.

Washington claims the top spot, with businesses in the state enjoying an 86.4% chance of surviving their first year, 89.3% in their second year, and an impressive 91.8% in their third year. These figures highlight Washington’s robust support for young businesses, likely fueled by its thriving tech ecosystem and a generally favorable economic climate.

California ranks second, with survival rates of 86.0% in the first year, 89.8% in the second, and 91.4% in the third. Despite challenges such as high costs of living and regulatory complexities, California’s strong economy, innovation hubs, and access to venture capital contribute to its high ranking.

Outside of the West Coast, West Virginia—whose economy is deeply rooted in energy production, natural resources, and manufacturing—ranks third, boasting the highest third-year survival rates at 91.9%. North Carolina—a major banking center and home of the Research Triangle—follows closely with similar numbers. At the opposite end of the spectrum, Minnesota businesses face the toughest challenges in their early years, with only 72.3% surviving their first year and 80.2% their second.

These regional differences highlight the importance of local economic conditions in shaping a startup’s odds of success. For entrepreneurs planning their next move, this analysis offers insight into where businesses are thriving and where challenges are more pronounced. Factors like industry presence, regulatory environments, and access to resources can create opportunities—or hurdles—that significantly affect survival rates in the critical early years. Choosing the right location isn’t just about personal preference; it can mean the difference between failure and success.

This analysis was conducted by Simply Business—an online insurance marketplace for small businesses—using 2024 data from the U.S. Bureau of Labor Statistics. Continue reading for complete results on all 50 states.

Full Results

Methodology

The data in this report comes from the U.S. Bureau of Labor Statistics’ Business Employment Dynamics. To determine the states where new businesses are most likely to succeed, researchers at Simply Business developed a business survival index. This index is based on a weighted average of the most recent survival rates for private-sector establishments during their first, second, and third years of operation, as of March 2024.

The survival rates were calculated using sequential benchmarks. The first-year survival rate is the percentage of businesses still active one year after opening. The second-year rate is the percentage of those first-year survivors that remained operational for another year. Similarly, the third-year rate is the percentage of second-year survivors that continued into the following year. The data focuses exclusively on private-sector businesses with at least one employee.