There are many steps you can take to prove you’re a responsible small business owner. This includes getting a certificate of insurance — a document that proves you have a current business insurance policy. Liability coverage can help financially protect your business in events such as accidents or lawsuits.

In this article, we’ll dive deeper into what a certificate of insurance is, how to get one, and how this type of document can benefit your business.

Let’s go!

What is a Certificate of Insurance?

A Certificate of Insurance, also referred to as a COI, is a document issued by an insurance provider. This document acts as proof to your customers that you have insurance coverage. So if property is damaged or someone is injured as a result of your negligence, the customers likely aren’t liable for covering costs.

Depending on your policy, these costs could include medical bills, property damage, and more.

A certificate of liability insurance typically includes:

- Your business’s mailing address

- Your business name

- The type of liability coverage you have

- How much money your policy covers

- And more

In this day and age, it’s rare to keep hard copies of documents. But in many cases, having a COI can greatly benefit your business. We’ll talk more about that further on. First, let’s address how to get a certificate of insurance for your company.

How to Get a Certificate of Insurance

1. Research different liability coverages.

Before you get a certificate of insurance, know what type of policy suits your business best. Two types of coverages are general liability insurance and professional liability insurance.

General liability insurance

General liability insurance, also referred to as commercial liability insurance, can help protect your business from third-party property damage, third-party accidents, bodily injury, and more.

For example, say you’re a carpenter building a new deck for a customer. The customer walks on the structure before it’s finished, falls, and breaks their leg. They charge you for the cost of their medical bills — a hefty sum.

Without a general liability insurance policy, you may face paying the claim out-of-pocket. That could put your business in financial debt. If you had coverage, things could look different. Your policy could also cover you for the claim and legal services, up to your policy’s limit.

Professional liability insurance

Professional liability insurance is coverage that helps protect you from claims for libel and slander, negligence or alleged negligence, copyright infringement, and more.

Let’s look at an example. A real estate agent may work with clients who give them permission to submit an offer on their behalf. The real estate agent gets distracted and forgets to make the offer and other buyers get the house. The clients sue the agent, claiming the agent’s negligence caused them to lose a potential home.

Without a professional liability policy, the real estate agent may face negotiating and paying for the claim out of their personal savings. And those costs could be detrimental to their small business.

If the real estate agent had a professional liability policy, though, it would be a different situation. They could be covered for the cost of the claim and legal bills, up to their policy’s limit.

Think that lawsuits like the ones above are few and far between? In reality, they’re more common than you may think. In fact, a study estimated that 36%-53% of business owners are involved in a lawsuit in a given year.

Remember that lawsuits cost time and money, even if your business is found not to be at fault. You would likely still be responsible for paying the attorney fees.

2. Get business insurance coverage.

It may go without saying, but before getting a certificate of liability coverage, you’ll need to get a policy.

You can begin reviewing your coverage options. Consider which is better for your business — general liability or professional liability.

Simply Business helps small business owners compare quotes.

This process is fast, easy, and affordable, too.

You can see your options in less than 10 minutes by using our free quote comparison tool here.

Get Insured in Under 10 Minutes

Get an affordable & customized policy in just minutes. So you can get back to what matters: Your business.

3. Download your COI.

Once you buy your insurance policy, be sure to get a copy of your certificate of liability insurance. With Simply Business, we make this easy.

After buying your policy, you will receive an email with your certificate of insurance attached. You also may access a downloadable COI in your Simply Business customer account.

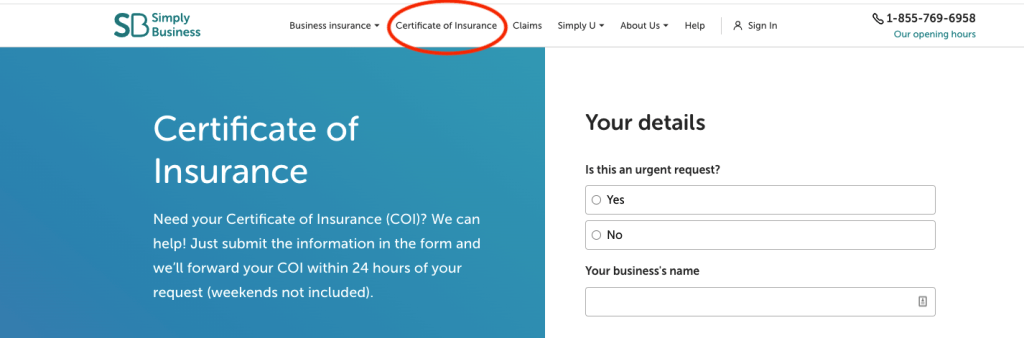

You can see an image of where to access that downloadable file below:

4. Add a certificate holder.

After a customer hires you, they can request a certificate of insurance. This comes from the insurance provider. In this case, they are considered the certificate holder. As the insured business, you are considered the policyholder.

Asking for the COI themselves can help put your customer’s mind at ease. This way, they can verify the certificate is current and the policy is active.

Reach out to ask (any time).

The option to get your certificate of insurance isn’t only when you buy your policy. You can easily get another copy sent to your email address. Reach out to a Simply Business licensed insurance agent at 855-769-6958 for assistance.

If you don’t have time to make the call, you can log into your customer account and access your COI download again. It’s available to you any time.

This ability can come in handy when you start working with a new customer — a benefit we’ll discuss further on.

6 Biggest Benefits of a Certificate of Insurance

1. It helps you land more work.

The certificate of insurance gives your customers a big benefit.

Without liability insurance coverage, they could face owing money. If someone gets hurt or property is damaged, your customers may be responsible for the corresponding bills and repairs.

Showing proof of insurance with a COI can put customers at ease. That’s because they know they’re financially protected by your insurance if you’re at fault for damages. If something untoward were to happen, your policy could cover the resulting claim.

Think of other small businesses you may compete with. Do you think your customers are more likely to work with an uninsured company or one with coverage? Having a policy can put you ahead of your competitors.

2. It helps you meet requirements and regulations.

Business insurance requirements are different, depending on which states you do business in. You may need to get business insurance to meet your state’s legal requirements.

Your state may not require you to have business insurance or show proof with a COI. But there’s a good chance you may be required by another party. For example, your local city or municipality may require proof of insurance for businesses.

Check with your Secretary of State’s office to learn more about your state’s specific insurance requirements.

3. It helps you get approval with vendors, landlords, and more.

Government agencies are just one type of organization that may need to see proof of coverage. Vendors you work with or landlords who you rent space from — whether a workshop or storage space — may require you to show a COI.

Customers aren’t the only group who want to be assured they won’t be liable for an incident. Consider the other groups you work with too.

Let’s consider an example. You keep your tools and equipment in a storage unit. Some corrosive liquid you have stored leaks and ruins the storage unit.

Instead of the storage company being responsible for covering repair costs, your insurance coverage would likely cover repairs up to your policy’s limit.

4. It can help protect your business if you hire subcontractors.

Your business may not be at the point in its growth where you’re ready to hire employees. But you may want to hire subcontractors to help with a project. In that case, certificates of insurance can come in handy in more ways than one.

First, you can add your subcontractor as an “Additional Insured” to your policy. That detail is reflected on your updated certificate of liability insurance. You can show customers that a subcontractor is covered when you add them to your policy .

Second, a subcontractor can show you their policy’s certificate of insurance. (If they have one, that is.) This can put you at ease, ensuring that if the subcontractor is at fault for an accident, it’s their responsibility.

5. It can help you get financial assistance.

You may apply for financial assistance for your company, like a loan or grant. If so, the issuing organization may require applicants to show proof of insurance.

That’s because the organization is going to invest money in your small business. And they want to know that you’re financially protected against potential risks.

Imagine if they invested money in you, then an incident happened and you were uninsured. Your business may go bankrupt paying the claim cost, so their investment would have been for nothing.

To avoid that scenario, organizations request proof of liability coverage. Fortunately for you, that’s easy to do with a certificate of insurance. You can provide a digital file at any time by uploading it into your loan or grant application.

6. It acts as an outward sign of liability protection.

Maybe you have flyers at a local hardware store. Or you recently launched a website for your small business to have a digital presence.

Either way, there’s an advantage to displaying your certificate of insurance. Potential customers could browse your storefront and know you have proof of coverage.

Your business is financially protected against risk if a customer decides to shop with you. Your insurance carrier would likely assume liability. This means they may not have to pay claim costs.

A Certificate of Insurance Assures Your Customers

We’ve covered a lot of ground! By now, you know what a certificate of insurance is and the steps on how to get one. You also know how a COI benefits your business in multiple ways.

You may be motivated to get more customers. Or just to protect your hard work. Whatever drives you, we hope you realize how easy — and important — it is to have a COI.

Curious about what else you can do to protect your business? Learn more at Simply U, our blog for business owners.