Insure your small

business in minutes.

Insure your small

business in minutes.

Compare quotes from top-rated insurers and get instant

proof of coverage, 24/7.

Compare quotes from top-rated insurers and get instant proof of coverage, 24/7.

Rates as low as $20.75/month*

Exclusively dedicated to small businesses

No hassle. Just savings

Built for small businesses. Backed by experience.

400+

business types covered

4.6/5

customer rating on Trustpilot

1M+

customers worldwide

18

top-rated small business

insurance carriers

Built for small businesses. Backed by experience.

400+

business types covered

4.6/5

customer rating on Trustpilot

1M+

customers worldwide

18

top-rated small business

insurance providers

Fast coverage. Zero hassle. Just the right insurance for your business.

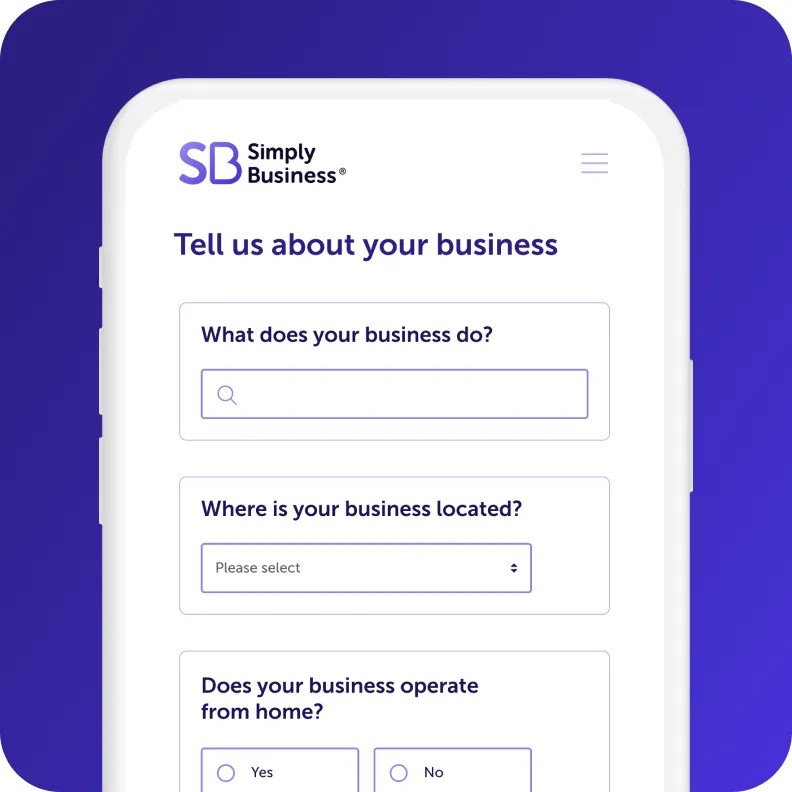

Answer a few questions about

your business in one form.

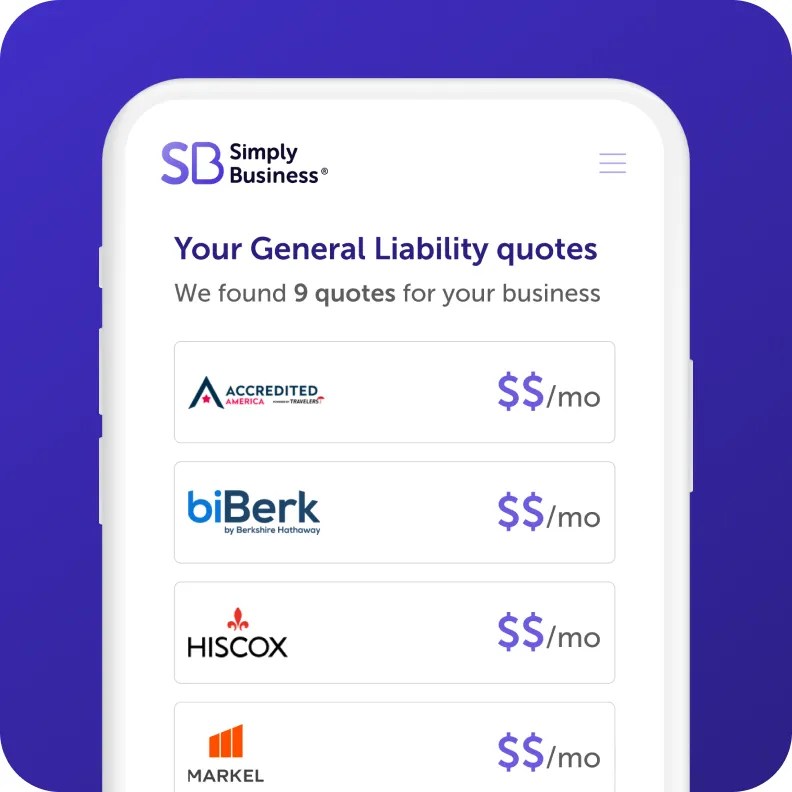

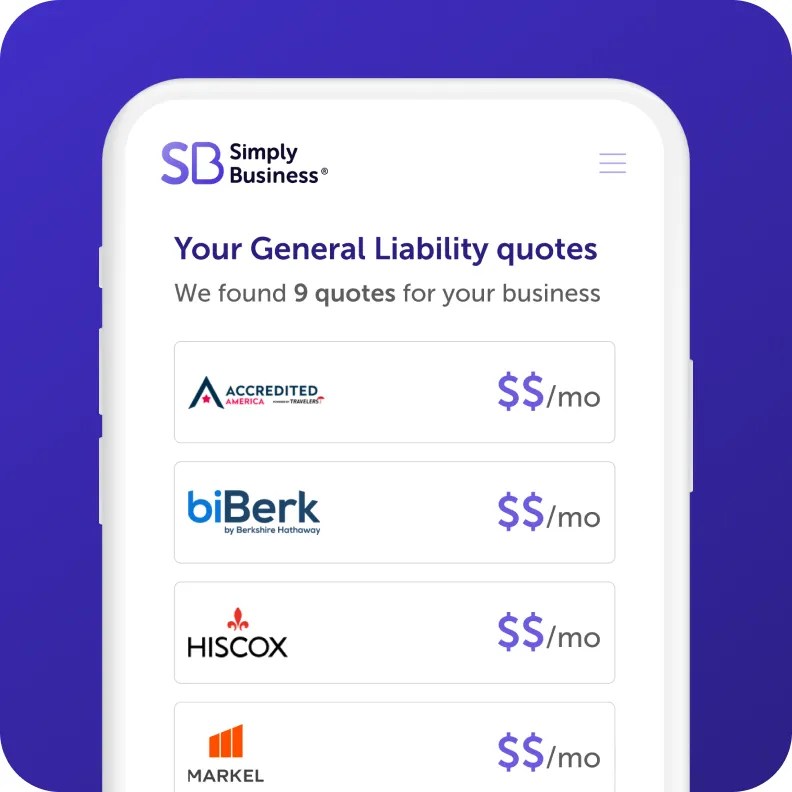

Compare quotes side by side

from top-rated insurers.

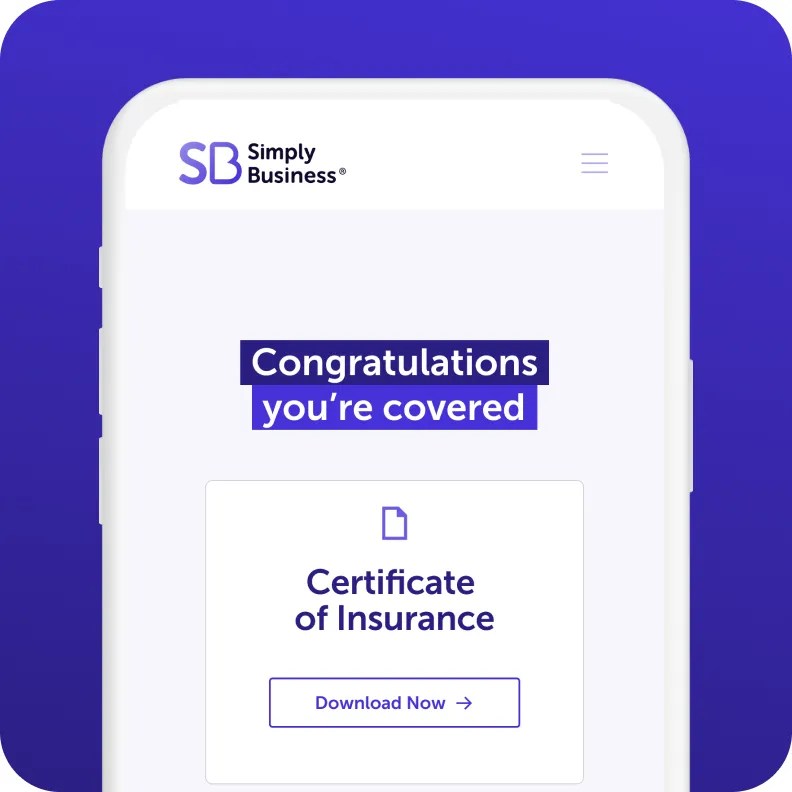

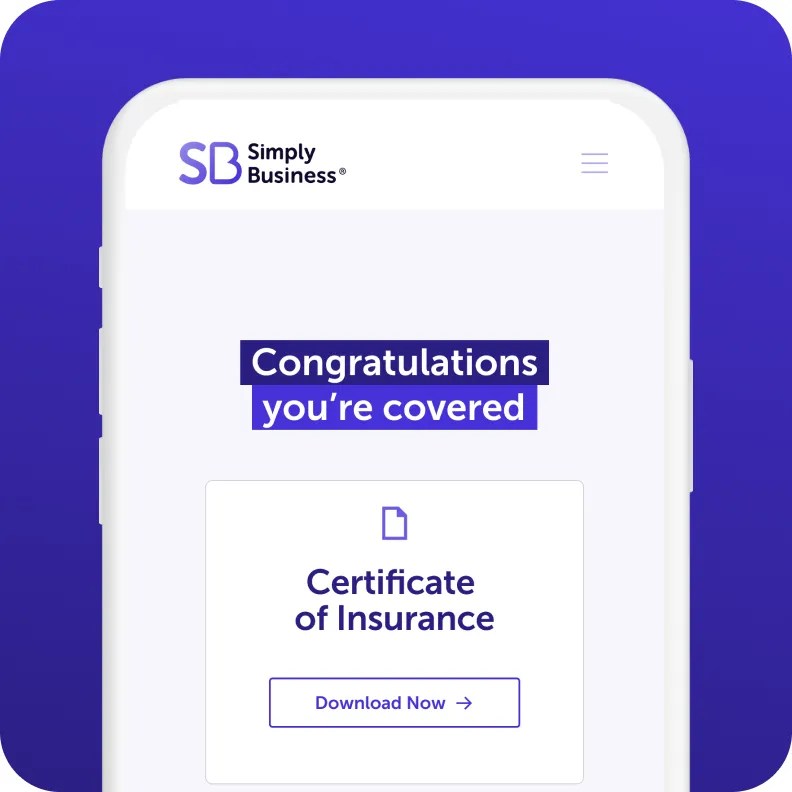

Choose your policy and get

instant proof of insurance.

Fast coverage. Zero hassle. Just the right insurance for your business.

Answer a few questions about

your business in one form.

Compare quotes side by side

from top-rated insurers.

Choose your policy and get

instant proof of insurance.

We cover 400+ types of businesses. Including yours.

Don’t see what you’re looking for? No worries. You can find more businesses here.

Get the coverage you need. Nothing you don’t.

General Liability Insurance

Coverage for third-party accidents, property damage, and bodily injury. This policy is the most common type of insurance for many small businesses.

From

$20.75

/month*

Workers’ Comp Insurance

Coverage to help take care of employees who get sick or injured on the job. Many states require this for businesses with full or part-time employees.

From

$38.91

/month**

Professional Liability

Coverage for damages and legal costs due to mistakes or negligence claims. This policy is often recommended for businesses that provide advice and guidance to their clients.

From

$25.83

/month†

Business Owner’s Policy (BOP)

General liability, property insurance, and more all in one convenient package. A BOP policy typically lets you add different types of coverage to meet the needs of your specific business.

From

$33.75

/month‡

We’ve insured over 1 million businesses worldwide — and counting.

See what others have to say.

Highly recommend Simply Business! So easy to get started, they are also quick and responsive to your unique needs.

Kimberly B, via Trustpilot

Just a few clicks and I had what I needed. Very easy process and well explained. I’m very pleased 😀

Amanda, via Trustpilot

I’ve saved $350 with one of your quotes I didn’t find before. Thank you!

Anna, via Trustpilot

This block is configured using JavaScript. A preview is not available in the editor.

Get an expert recommendation in seconds.

We’ll show you the coverage you need and an estimated price.

Questions? We’ve got helpful answers.

*The displayed price for each product is a monthly estimate calculated from the 10th percentile of relevant policies sold by Simply Business (e.g., General Liability data is used for General Liability estimates). This estimate uses data from relevant policy sales between January–June 2025. Final price and payment terms, which may include an initial down payment, are subject to change based on your state, selected insurance provider, and specific business details.